George Osborne, the government’s Chancellor of the Exchequer has given his annual Autumn Statement to parliament which sets out financial plans based on the most up-to-date forecasts from the Office for Budget Responsibility (OBR). It highlights the UK’s taxation and public spending plans for the coming year. This is the last before the general election.

For the first £125,000 no tax will be paid.

Tax & Savings

· Funding for Lending (FLS) has been extended for another year.

Live Updates from 3 December 2014 (GMT)

13:27 – 50min speech now over, questions await.

13:24 – Stamp duty will be completely reformed- Stamp duty will be completely reformed.

13:21 – The tax-free Personal Allowance rise instead to £10,600.

13:19 – Currently, when someone dies, ISA will lose its tax-free status – now this can be passed on tax-free.

13:18 – UK on track to meet welfare cap commitment.

13:17 – Hospices to be refunded VAT.

13:16 – Death Tax abolished, pass on pensions to loved ones tax-free.

13:14 – Post-graduate students will now be able to apply for student loans. They will be able to borrow up to £10,000 to fund their post-graduate studies – nothing for Undergraduates.

13:12 – Build a Northern Powerhouse (transport systems)

13:11 – UK ranked 2nd for global innovation.

13:10 – UK apparently raising financial ambitions.

13:08 – Fall in global oil price has helped the UK.

13:07 – Reducing Air Passenger Duty (APD) for children under 12 on budget flights, and then under 16s in the next few years.

13:06 – Fuel duty cut and will remain so.

13:05 – Funding for Lending Scheme extended by a further year

13:05 – the amount of profit in established banks that can be offset by losses carried forward will be limited to 50%, and relief on bad debts delayed.

13:04 – “We are in this together”

13:04 – 25% “Google” tax on profits for multinationals that shift profits offshore, named: diverted profit tax.

13:03 – Extra £2bn to NHS and £1.2bn investment to GPs.

13:02 – Banks to contribute more in tax

13:02 – UK’s budget deficit halved since 2010

13:00 – “Total welfare spending to be £1bn a year lower than forecast at the Budget. Universal Credit work allowances will be frozen for a further year… unemployment benefits will stop for migrants with no prospect of work”

12:58 – Tax avoiding schemes to raise £5bn

12:57 – “Cannot have a strong NHS without a strong economy”

12:55 – Share of GDP/ national income at deficit of 5% – higher than France and Italy

12:50 – Government borrowing forecast is £91.3bn this year and £75.9 billion in 2015.

12:48 – UK 4bn surplus in 2018-19

12:46 – OBR expects above inflation rises in wages over the next 5 years

12:45 – Unemployment forecast to fall to 5.4% next year

12:43 – Employment over 500,000 new jobs have been created

12:42 – UK growth forecast raised to 3.0% for 2014

12:42 – UK economy expects 3% growth

12:41 – UK growth isn’t very high due to apparent slow growth of other global markets

11:29 – Chancellor leaves the Treasury to deliver the Autumn Statement

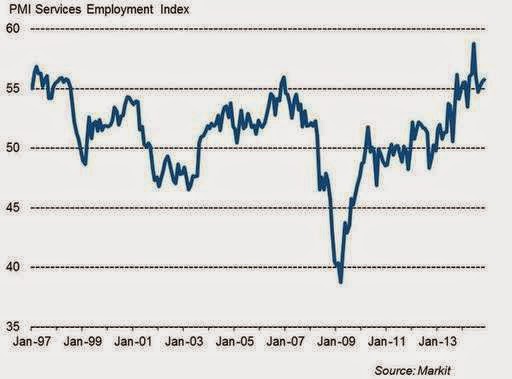

10:46 – PMI Service Employment Index from January 1997 – January 2013

Related Links:

GOV.UK – Statement 2014

BBC Updates

Pensions

.png)